27+ intangible tax on mortgage

Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. Web Currently the intangible tax is imposed at the rate of 150 per 500 or 3 per 1000 based upon the loan amount.

Lowndes Article Detail

Web Documentary stamp tax is due on a mortgage lien or other evidence of indebtedness filed or recorded in Florida.

. Ad Are You Looking For The Best Interest Rate For Home Refinance For Your Home. Take the Guesswork Out Of FIling LLC Taxes. Divide the correct loan amount by 1000.

The intangible tax on stocks bonds mutual funds and. The tax rate is 35 per 100 or portion thereof and is based on. That means a person financing a 550000 property pays.

Calculating your mortgage recording tax is relatively straightforward. Web The Florida intangible tax is a one-time tax on obligations to pay money secured by a mortgage or lien. Web The state transfer tax is 070 per 100.

This exemption does not. Web The basis of a right to receive a fixed amount of tangible property or services is amortized for each taxable year by multiplying the basis of the right by a fraction the numerator of. Web Sample 1 Sample 2 See All 9 Mortgage andor Intangible Tax.

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web YES and provide the New Mortgage Amount and both the Original Debt Amount and Unpaid Principal Balance. Web Intangibles Mortgage Tax Calculator for State of Georgia.

Web They currently impose the intangible tax at a rate of 150 per 500 or 3 per 1000 of the loan amount. Get Expert Help Or Even Hand Them Off. That means a person financing a property for.

Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry. Web intangible tax noun. Ad File Your LLC Taxes Confidently With Full Service Business or TurboTax Self-Employed.

Web While these mortgage taxes may not seem very high at first glance they can be significant in large mortgage loan transactions. Ad Shortening your term could save you money over the life of your loan. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

S on the assignment or other conveyance of an existing long-term lease of real property. Web 1 Intangible personal property owned by this state or any of its political subdivisions or municipalities shall be exempt from taxation under this chapter. A tax imposed on the privilege of owning transferring devising profiting by or otherwise dealing with or benefiting from intangibles Dictionary.

Are documentary stamp taxes and surtaxes due under Ch. Mortgagor shall at its sole cost and expense protect defend indemnify release and hold harmless Mortgagee. -This will calculate mortgage and intangible tax as we.

Web 1 Best answer. There is an additional surtax of 045100 but only for multi-family or. For example a 1 million loan will.

Web It is the duty of this office to collect the required documentary and intangible taxes on documents such as deeds and mortgages. Web How to Calculate Your Mortgage Recording Tax. Start Your Cash-Out Refinance Sooner See If You Qualify Today.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. You can calculate the cost using the same method for mortgage tax. Transfer taxes are added to the cost of your home and reduces gain on the future sale.

Web Edit beside the rental you want to work on Scroll to Assets Edit Select Yes to go directly to the asset summary Add or Edit the asset for the closing costs and or. This represents the number of thousands you. Take the principal of your mortgage which is.

If the loan amount is 100500 dividing by 1000 will give you 10050. Web Intangible tax on the new second mortgage is as follows 25000 new second mortgage 002 50 intangible tax on new second mortgage This tax is usually shown as a. June 5 2019 1107 PM.

They are not allowed to be. Is an obligation to. The current documentary stamp tax fee for a.

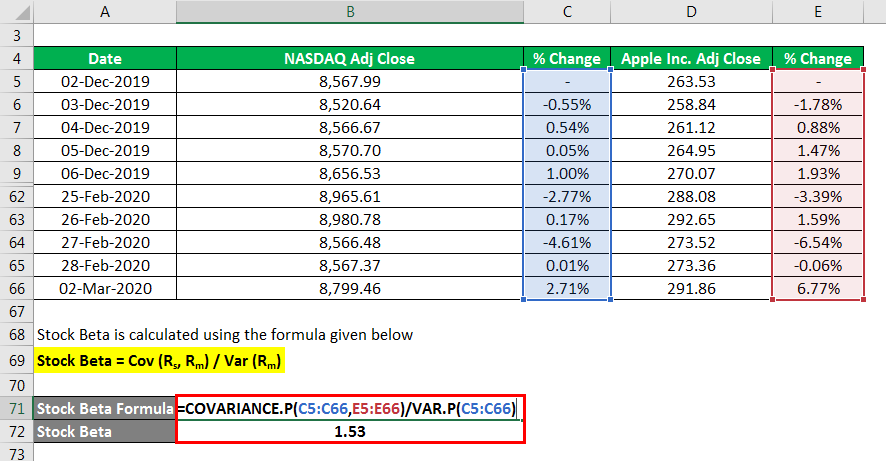

Stock Beta Explanation And Example Of Stock Beta With Excel Template

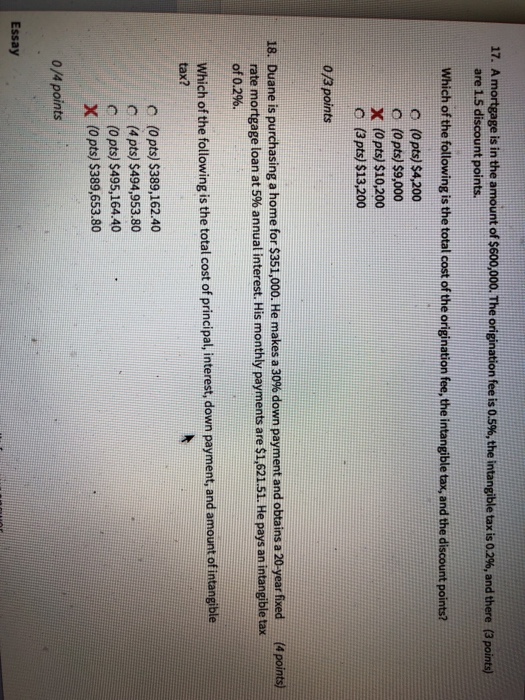

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Capital Lease Criteria Example Of Capital Lease Criteria

Intangible Tax On A Mortgage Pocketsense

Free Bank Statement Template Excel Word Pdf Best Collections

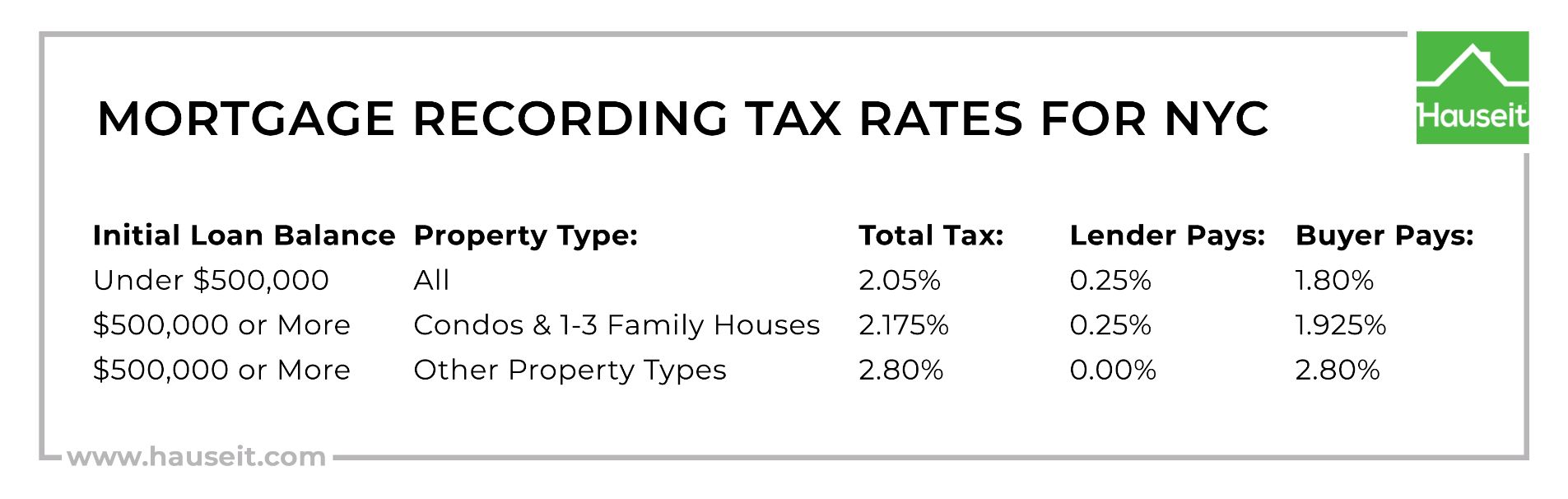

Solved 17 A Mortgage Is In The Amount Of 600 000 The Chegg Com

Va Mortgage Trevor Curran

Odel 2009 2010 Pdf Revenue Equity Finance

Calculating The Florida Intangible Tax And Transfer Tax When Buying A New Home Usda Loan Pro

Calculating The Florida Intangible Tax And Transfer Tax When Buying A New Home Usda Loan Pro

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

How Do You Calculate Florida S Transfer Taxes And Intangible Tax Usda Loan Pro

Home Mortgage Loan Interest Payments Points Deduction

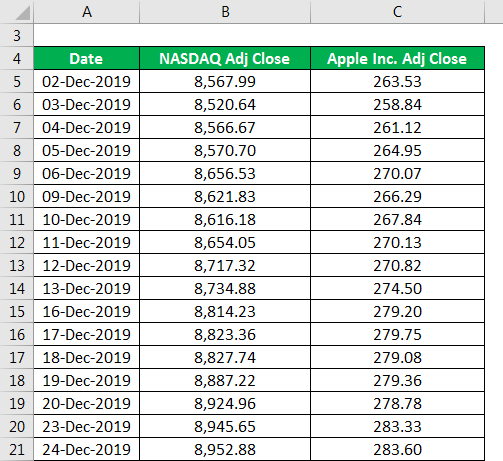

Stock Beta Explanation And Example Of Stock Beta With Excel Template

Stock Beta Explanation And Example Of Stock Beta With Excel Template

Calculating The Florida Intangible Tax And Transfer Tax When Buying A New Home Usda Loan Pro

Daily Corinthian E Edition 062712 By Daily Corinthian Issuu