35+ How to calculate mortgage borrowing

Find the right mortgage now. If you think that you may potentially benefit from a bridge loan but are unaware of how they work were here to help.

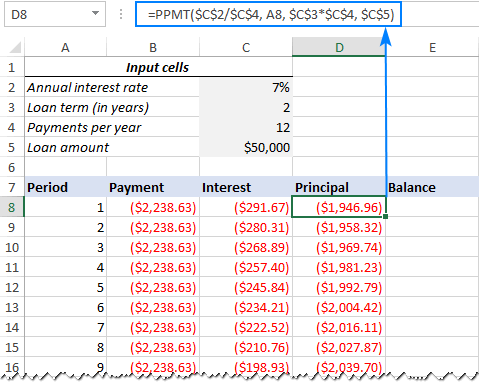

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

If you saved a 50000 deposit for a 200000 home your loan amount would be 150000.

. Interest is easy to calculate. Applications are subject to status and lending criteria. When using the repayments calculator bear in mind that the property price minus the deposit amount shouldnt be any more than the borrowing amount.

To calculate net. Divide this sum by the property value. Calculate your loan Find out in just two minutes how much you can borrow and what your monthly repayments will be.

2020 is expected to be a record year for mortgage originations with Fannie Mae predicting 41 trillion in originations and refinance loans. Get a mortgage with a minimum 5 deposit. While both a HELOC and a second mortgage use your home equity as collateral a second mortgage can offer you access to a higher total borrowing limit at a higher interest rate.

Bridging finance is an alternative form of lending to traditional mortgage finance. This is a result of the time value of money principle since money today is worth more than money tomorrow. If you opt to use an escrow account or your lender requires it youll also have your property taxes mortgage insurance and homeowners.

35 or even 40 years. How much youll pay is indicated by your interest rate. Cost of debt refers to the effective rate a company pays on its current debt.

Any remaining current borrowing. Or your browser is blocking ad display with its settings. To calculate the LTV ratio divide 150000 by 200000.

How to Calculate Mortgage Payments in Excel With Home Loan Amortization Schedule Extra Payments. Borrowing Loans mortgages. You most likely have money left over for saving or spending after youve paid your bills.

Loan Amount Down Payment Loan Term 1 years 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years Additional Months 0 mont. Applicants must be UK residents aged 18 or over. In most cases this phrase refers to after-tax cost of debt but it also refers to a companys cost of debt before.

Monthly Capital Interest. To determine which mortgage default insurance premium rate you have to pay the first step is to calculate how much your down payment is as a percentage of your homes purchase price. Payments per year - defaults to 12 to calculate the monthly loan payment which amortizes over the specified period of years.

This can be up to 95 of your homes value compared to the 65 limit for a HELOC. Get breaking Finance news and the latest business articles from AOL. As the Federal Reserve bought Treasury bonds and mortgage-backed securities while the economy cooled mortgage rates fell to new record lows.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE. Youre managing your debt adequately but you may want to consider lowering. For this example lets say you have a 330K mortgage with a 10-year-term a monthly payment of 1500 and that you paid 2000 in points and 2000 in origination fees.

Sign the quote If you are already an ABN AMRO customer we will send you a. Obligations commonly used to calculate your debt-to-income ratio include mortgage including escrowed taxes and insurance or rent payments car payments student loan payments personal and other loan payments loan payments on any loans youve co-signed an important line item for parents with debt-burdened adult children alimony child support home. As part of the total loan payment each period the borrower must make a payment towards interest.

The amount we will lend depends on your circumstances the amount borrowed and the property. This money is applied straight to your loan balance. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment.

Bonds securitizing mortgages are usually. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buy. The cost of borrowing the money.

A higher deposit may be required for a flat or new build. Heres what typically makes up a mortgage payment. The lender charges interest as the cost to the borrower of well borrowing the money.

Request a no-obligations quote We will send you a quote with no strings attached you have 30 days to consider our offer. Telegraphic transfer standard is 35. We noticed that youre using an ad blocker.

You could potentially in some circumstances borrow up to a maximum of 90 of the value of your home. If you have made an overpayment by card using Manage Your Mortgage the payment is usually applied within a few hours. However if you want to learn how to calculate the APR here is a step-by-step guide on how to calculate the APR of a fixed-rate mortgage.

A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. Mortgage default insurance rates CMHC insurance rates 1. Lenders generally view a lower DTI as favorable.

We will call you to walk you through the terms and conditions. Find out how much you could borrow or calculate your repayments. It offers amortization charts.

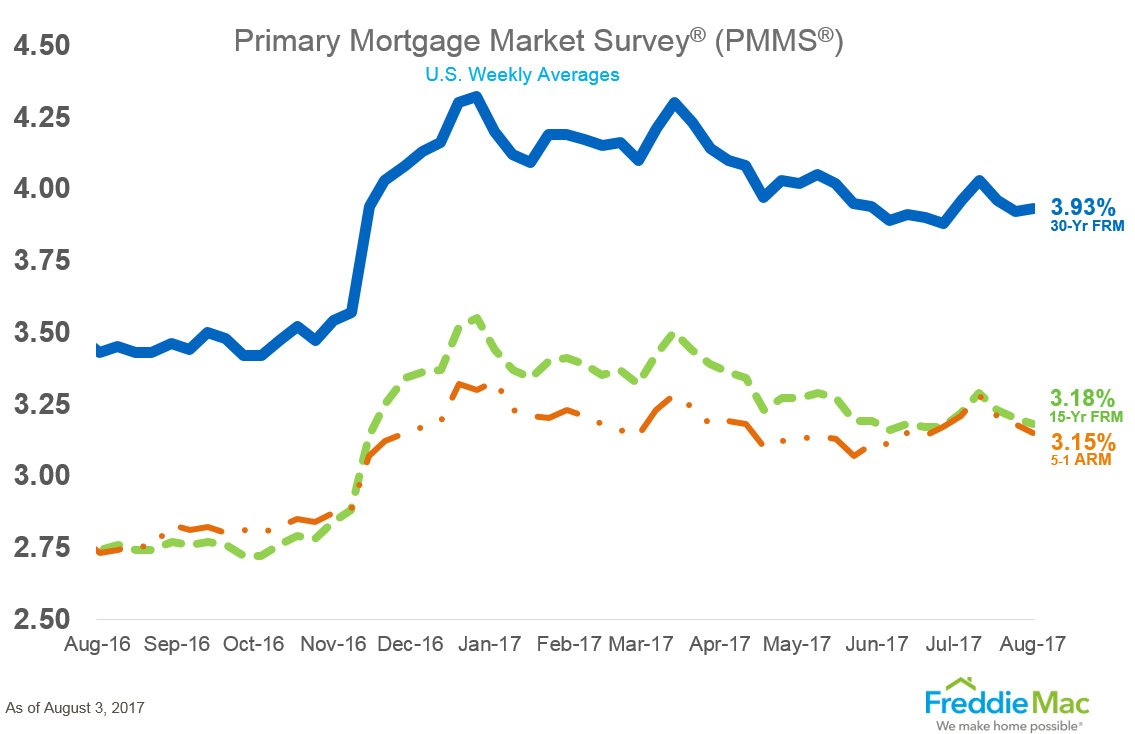

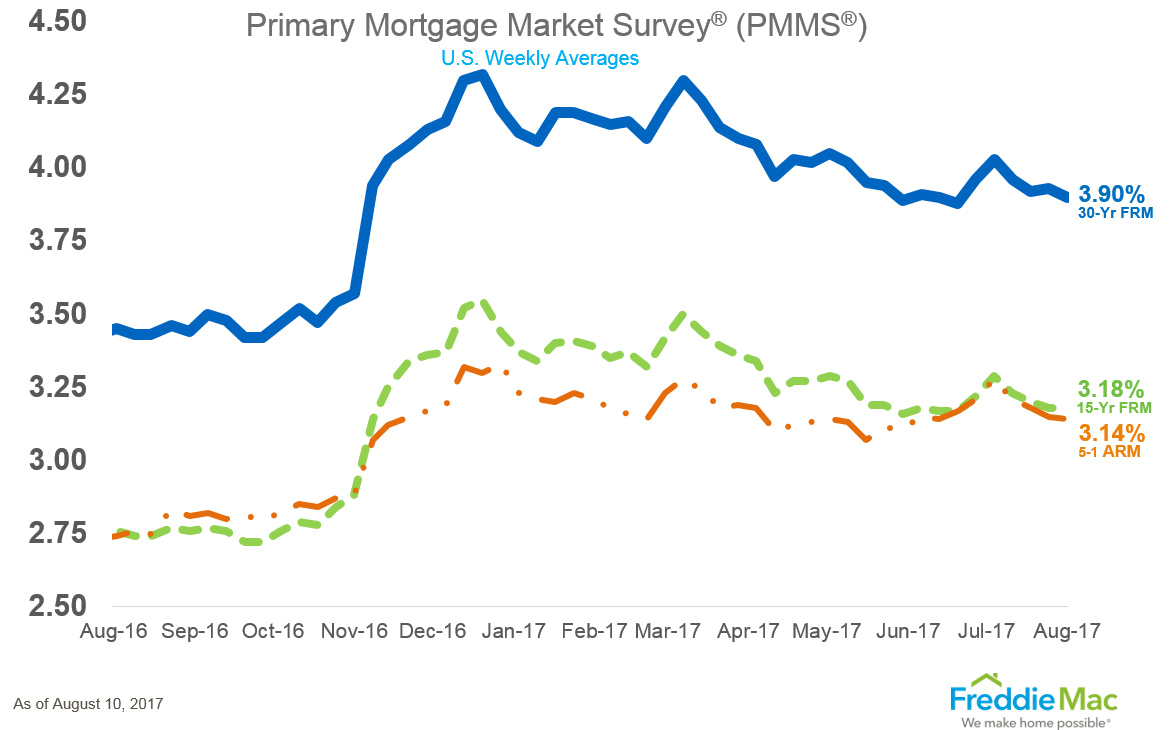

Multiply that figure by 100 to calculate the percentage of your gross rental yield. On the week of November 5th the average 30-year fixed-rate fell to 278. If you have made an overpayment using another method such as a bank transfer or standing order please allow up to 5 working days for your overpayment to be applied to your mortgage balance and reflected in your Loan to Value.

From stock market news to jobs and real estate it can all be found here. Looking Good - Relative to your income your debt is at a manageable level. Try this free feature-rich mortgage calculator today.

Calculate the sum of the total annual rent the tenant is charged. The mortgage repayment calculator can help you find a mortgage product to suit your requirements and calculate what your monthly repayments could be. Your access to our unique and original content is free and always will be.

The chart below outlines the premium rates for each down payment scenario. Net yield is the income return on an investment after all expenses such as insurance maintenance and strata fees have been deducted. Borrow more on your Royal Bank of Scotland residential mortgage to help realise your plans for those home improvements dream holiday etc.

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So

Your Adjustable Rate Mortgage Needs To Be Refinanced

Contribute To My 401k Or Invest In An After Tax Brokerage Account

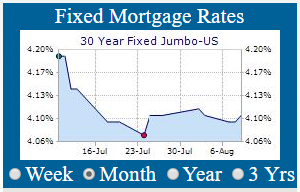

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Excel Nper Function With Formula Examples

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Excel Ppmt Function With Formula Examples

Excel Ppmt Function With Formula Examples

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Will I Get Home Loan For Buying My Father S House Quora

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Mortgage Calculator Mortgage Calculator Reverse Mortgage Amortization Calculator Revers Mortgage Amortization Mortgage Amortization Calculator Online Mortgage

I M 23 Years Old And Buying My First House What Are Some Strategies I Can Use To Payoff My Mortgage Early Quora

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So